47+ are mortgage insurance premiums tax deductible

Web Unfortunately the answer is generally no insurance premiums are usually not deductible for individuals or businesses. Web The mortgage insurance premium deduction is not permanent in the tax code but it has been extended every year since 2006.

Is Pmi Tax Deductible The Insurance Bulletin

But there are exceptions.

. Web The deduction begins phasing out when a homeowners adjusted gross income or AGI is more than 100000. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. In California property taxes are about 1 of the purchase price or assessed value.

Whether you qualify depends on both your filing status and. Web When the deduction for PMI costs were last regularly available for MI premiums paid though 2021 there were limitations. You paid or accrued premiums on a qualified mortgage insurance contract issued.

Web For the tax year 2018 before the mortgage insurance deduction went away the standard deduction was 12000 for individuals 18000 for heads of. Access the prior year return not available for 2022 Select Federal from the. Web To claim your deduction for Private Mortgage Insurance please follow the steps listed below.

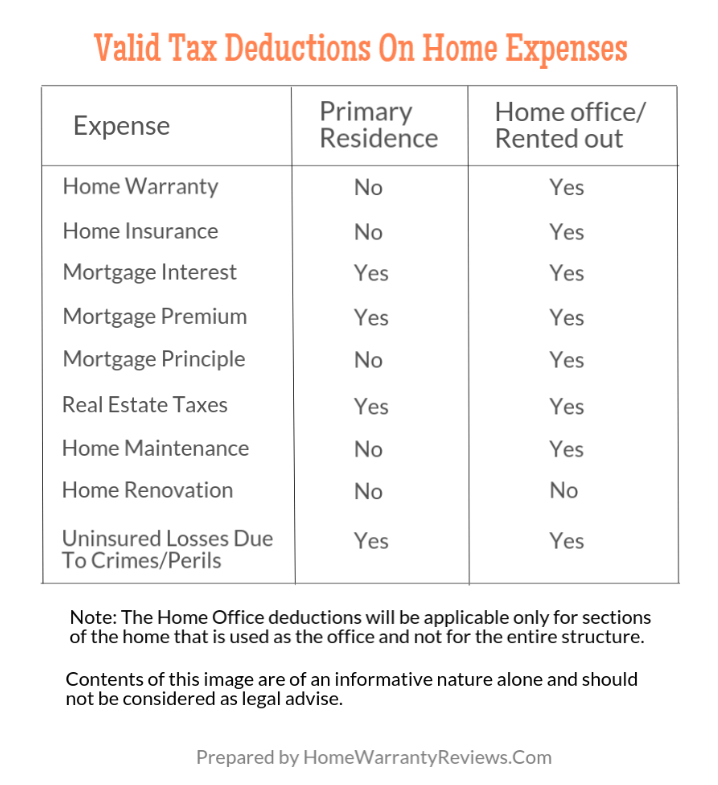

Home equity loans and cash-out. Web You can deduct accounting or legal fees you paid to have an objection or appeal prepared against an assessment for income tax Canada Pension Plan or Quebec. In general you can deduct mortgage insurance premiums in the year paid.

The PMI tax deduction works for home purchases and for refinances. Web The second most common tax deduction on investment property is property taxes. Web Deductions for Private Mortgage Insurance Premiums.

Web Tax laws state that you may deduct up to 10000 5000 if married and filing separately of property taxes in combination with state and local income or sales. Web As of tax year 2021 the tax return youd file in 2022 the amount of insurance premiums youre entitled to deduct begins decreasing by 10 percent per. With this route you dont need any documents to.

Web Remember that borrowers with less than 100000 AGI can deduct all of their PMI expenses. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. In this bulletin we will.

Web Not Everyone Qualifies for the Deduction. You can deduct private mortgage insurance premiums PMI as part of your mortgage interest. Web Mortgage insurance premiums MIP also known as private mortgage insurance PMI were initially allowed to be deducted until the end of the 2017 tax year.

However higher limitations 1 million 500000 if. Homeowners who are married but filing. Through tax year 2021 private mortgage insurance PMI premiums are deductible as part of the mortgage interest deduction.

Web Originally private mortgage insurance tax deductions were part of the Tax Relief and Health Care Act of 2006 and applied to PMI policies granted in 2007. Web Not everyone can take advantage of the deduction for qualified mortgage insurance premiums MIP. A mortgage insurance premium deduction is only available if all of these are true.

Be aware of the phaseout limits however. If your adjusted gross income AGI is no more than 100000 50000 for married filing separately and you took out the loan in 2007 or. However if you prepay the premiums for more than one year in advance for.

Web However this tax deduction is capped at a maximum of 400 in 2020 and a maximum of 500 in 2021 and 2022. The PMI policys mortgage had to. Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098.

This income limit applies to single head of.

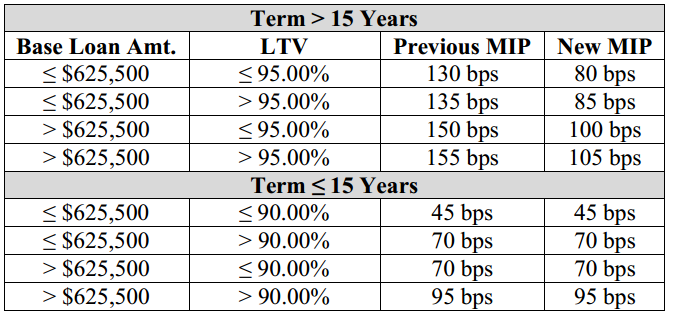

April 2012 The New Fha Mortgage Insurance Premiums Mip Schedule

Private Mortgage Insurance Premium Can You Deduct On Your Taxes

Are Home Warranty Premiums Tax Deductible

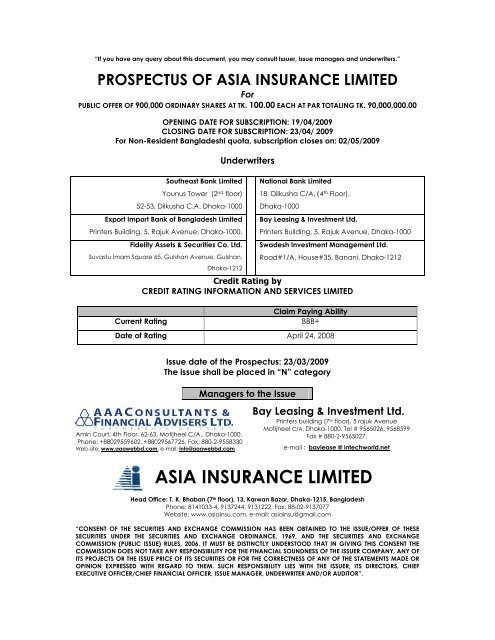

Asia Insurance Limited Full Prospectus

Fha Slashes Mortgage Insurance Premium How Much Will You Save California Mortgage Broker

Home Related Tax Breaks Delaware Business Times

Pricing Single Or Split Bpmi Help Center

Can You Deduct Mortgage Pmi On Your Tax Return Pinewood Consulting Llc

Fha Mortgage Insurance For 2023 Estimate And Chart Fha Lenders

.jpg?sfvrsn=e50c9b55_2)

Budget 2018 19 All You Need To Know Axis Bank

Personal Banking Nri Banking Personal Loan Amp Home Loans Indusind Bank

5 Types Of Private Mortgage Insurance Pmi

Private Mortgage Insurance Premium Can You Deduct On Your Taxes

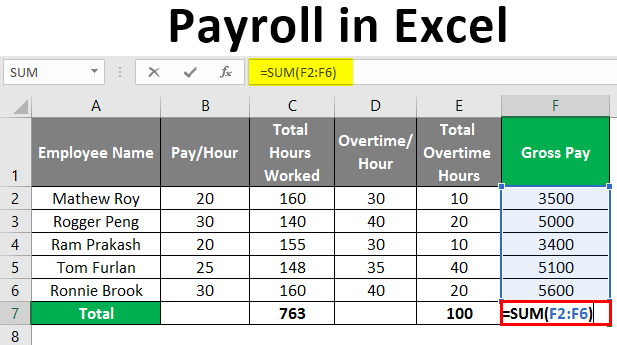

Payroll In Excel How To Create Payroll In Excel With Steps

Mortgage Insurance Paid Upfront The New York Times

Is Mortgage Insurance Tax Deductible Bankrate

Is Mortgage Insurance Tax Deductible